LIC Bangalore online policy

In today’s dynamic economic landscape, ensuring the financial security of our loved ones and planning for our own future has become more critical than ever. From safeguarding our children’s education to securing a comfortable retirement, every stage of life demands prudent financial planning. In this comprehensive guide, we will explore various facets of financial planning, focusing on Bangalore-specific LIC policies for child education, term insurance, tax-saving strategies, retirement planning, generating lifetime monthly returns, investing in mutual funds through SIPs, combating inflation, avoiding the bank interest trap, and understanding fixed income schemes.

Bangalore LIC Buy Policy for Child Education: Bangaloreans understand the significance of providing quality education to their children. LIC policies tailored for child education serve as a robust financial tool to fulfill this aspiration. These policies offer a dual benefit of life insurance coverage and a dedicated corpus for your child’s education expenses. By investing in LIC’s child education policies, Bangalore parents can secure their children’s future education while enjoying tax benefits under Section 80C of the Income Tax Act.

Term Insurance and Its Crucial Role:

Term insurance forms the bedrock of financial planning by providing a safety net for your family in the unfortunate event of your demise. In Bangalore’s bustling environment, where uncertainties loom large, having adequate term insurance coverage is imperative. Term plans offer high coverage at affordable premiums, ensuring that your loved ones remain financially protected even in your absence.

Tax Savings Strategies for Bangalore Residents:

Navigating through Bangalore’s burgeoning expenses can be daunting, but effective tax-saving strategies can ease the burden. Residents can leverage various investment avenues like Equity Linked Savings Schemes (ELSS), Public Provident Fund (PPF), National Pension System (NPS), and LIC policies to optimize their tax savings. By strategically allocating investments, Bangaloreans can maximize tax deductions while securing their financial future.

Retirement Planning in the Garden City:

As Bangaloreans embrace a work-life balance, planning for retirement becomes paramount. Whether you envision a serene post-retirement life in the city’s verdant locales or wish to explore new avenues, diligent retirement planning is the key. By investing in retirement-oriented schemes like pension plans, mutual funds, and other long-term investment options, Bangalore residents can build a robust retirement corpus and enjoy their golden years worry-free.

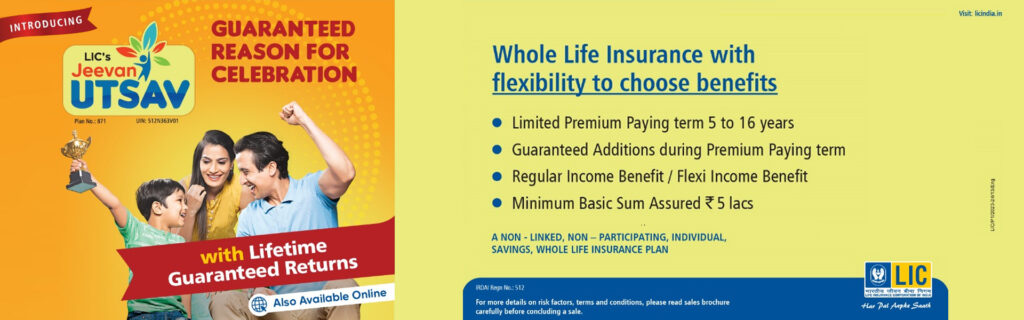

Generating Lifetime Monthly Returns:

In Bangalore’s fast-paced lifestyle, having a steady stream of monthly returns can provide financial stability and peace of mind. Annuities, dividend-paying stocks, rental income from real estate, and systematic withdrawal plans from mutual funds are viable options for generating lifetime monthly returns. By diversifying investments across these avenues, Bangaloreans can ensure a steady income flow throughout their lives.

Mutual Funds SIP: A Gateway to Wealth Creation:

Systematic Investment Plans (SIPs) offered by mutual funds present Bangalore investors with an accessible route to wealth creation. SIPs facilitate disciplined investing by allowing individuals to invest small amounts regularly. Through SIPs, Bangaloreans can harness the power of compounding and mitigate market volatility, thus achieving their long-term financial goals with ease.

Combatting Inflation Through Strategic Investments:

As Bangalore witnesses rapid economic growth, inflation remains a persistent concern. However, savvy investors can beat inflation by opting for investment avenues that historically outpace inflation. Equities, real estate, and precious metals are popular choices for Bangaloreans seeking to safeguard their wealth against inflationary pressures.

Avoiding the Bank Interest Trap:

While bank interest may seem like a safe option, it often fails to keep pace with inflation, eroding the real value of savings over time. To avoid falling into this trap, Bangalore investors should diversify their portfolios and explore alternative investment avenues such as mutual funds, stocks, and bonds. By embracing a well-rounded investment strategy, Bangaloreans can optimize returns while minimizing risk.

Understanding Fixed Income Schemes for Financial Stability:

Fixed income schemes like bonds, fixed deposits, and debt mutual funds play a crucial role in ensuring financial stability. These schemes offer predictable returns and serve as a hedge against market volatility. Bangalore residents can allocate a portion of their portfolio to fixed income schemes to balance risk and maximize overall returns.

At the end, proactive financial planning is essential for achieving long-term financial security and realizing life goals in Bangalore’s dynamic environment. By leveraging LIC policies for child education, term insurance, tax-saving strategies, retirement planning, generating lifetime monthly returns, mutual funds SIPs, combating inflation, avoiding the bank interest trap, and understanding fixed income schemes, Bangaloreans can navigate the financial landscape with confidence and secure a prosperous future for themselves and their loved ones.